FI/RE: A Revolutionary Snowball Rolling Movement

Everyone aims to retire for their career at some point in their lifetime. The thought of retirement creeps slowly after each subsequent work anniversary until one day something snaps. You think to yourself - What would it be like to not:

- "have to report to someone?"

- "have any deadlines?"

- "have to sit at a desk 6-8 hours a day?"

For most people that's what what life is like when you have achieved retirement. So, early retirement is a topic that turns a lot of heads, because who would want to continue to do the above for another 10-20 years of their life? Oftentimes many people, who are seemingly stuck in the forever Monday to Friday routine, get intrigued but are not sure where to start. Individuals that consider going into retirement in current times because they've met the service thresholds may find out that they won't have enough income or savings to cover their living expenses, thus delaying their retirement.

This is my personal take on how to get the snowball rolling for financial independence and early retirement.

The Prerequisites:

The following are some generic preflight checks someone should perform before they get on track. I highly recommend that you can check off all of the following before you begin. Failure to do so would result in more pain points and more overhead to achieve the end goal.

- Pay of any high interest debt, loans or lines of credit. There isn't any sense in chasing 7% in annualized stock gain every year if you are paying interest on a credit card with a 30% Annual Percentage Rate (APR).

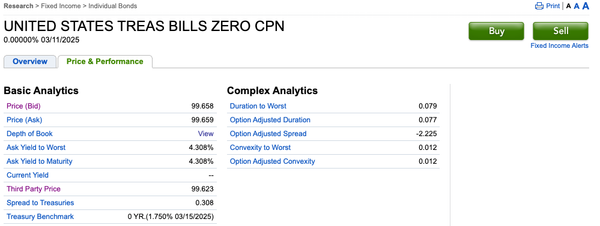

- Set aside 4-6 months of living expenses (rent/groceries/utilities/mortgage) for an emergency fund and put that in a HYSA, money market account, or short term treasury bills. I am a big proponent of the last.

Starting Out:

- Perform your own due diligence about any retirement accounts offered by your workplace that provide any tax or contribution advantages. Starting out and contributing the maximum amount to collect the entire employer match is a good way to begin. Reducing your tax burden in the near term is also a good play. Oftentimes your contributions will provide numerous tax benefits in the near-term and long-term.

- But keep in mind about your investment elections. Not all baskets are created equal, so it is important to do your homework about the type of investment buckets you can allocate your money in.

- Start contributing to your Roth IRA. These accounts are opened, funded, and operated by yourself. You call of the investment decisions, and all the gains you make are tax-free (with catches of course), but there are income limits to keep in mind when opening and contributing to this type of account.

- Start contributing to a Health Savings Account/Flexible Spending Account. This will reduce your tax burden in the near term.

- Start contributing to a 529 Savings Account. This account is for education related expenses and you can rollover unused funds, up to a certain limit, into a Roth IRA.

Continuing Forth:

- Stay the course, once you've mapped out the amount you can consistently contribute from your weekly paycheck, the only other ingredient left in the equation is time.

- Rebalance your portfolios, evaluate the micro and macro economic conditions that influence your perception. Just because you are told to invest in a "target date fund" doesn't mean you should. Target date funds have many downsides that can blindside the unknowing.

- Keep your expenses low. Your earned income may increase over time and you may fall into lifestyle creep. An increase in monthly expenses will hold you back and be detrimental.

- Save for the details: vacations, childbirth, home renovations, weddings, etc. Life is too short to not enjoy important and lasting occasions.

Future Proofing:

- Determine your end-game number. Or the number you have in mind in your accounts before you retire.

- Determine your end game withdrawal strategy. Many retirement accounts have age stipulations if you want to withdraw from them without penalty before you are in your early 60's. But there are IRS accepted strategies to utilize to withdraw penalty free early (but often subject to income tax).

- Determine your monthly expenses post retirement. If the rate at which you withdraw cannot keep up, then you would need to save more.

- Determine what you will do post retirement. Think about your hobbies, a small-business, or a less stressful line of work. Think about something to keep you in shape, something you enjoy, and something that can generate income.