Leveraging 4.25% Treasury Bills for 5+% Gains

Backstory

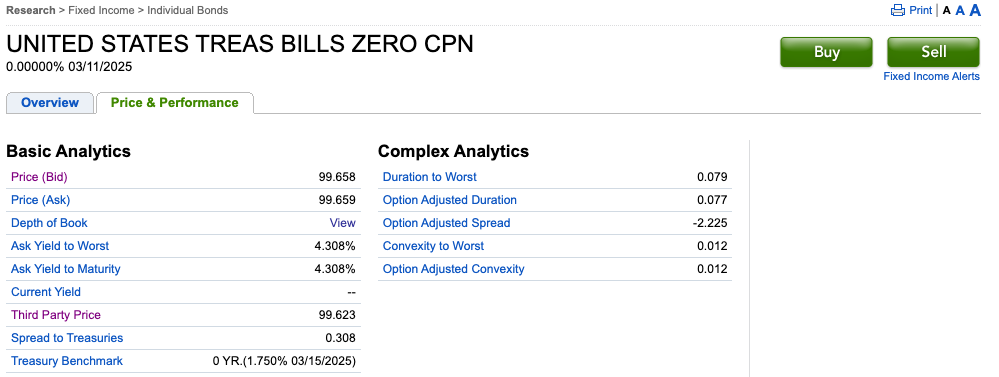

Recently, I've been leveraging 4-week treasury bills to generate some fixed income because of market uncertainty. I've noticed that due to, supposedly, short term rate changes, you can acquire treasury bills the moment they are auctioned in the secondary market for a much better rate. The auction price is sometimes higher than the current bid price of the t-bill on the secondary market.

Observations

Let's take this week's example: through the weekly auction you paid for your 4-week treasury bill for 99.67 (or 4.32%), but it was worth much less on the secondary market. Right now as of this post, if you sold the same t-bill on the secondary market, it is worth 99.62 (or 4.93%) and currently valued more than you paid for!

Questions

So I thought to myself:

- Why not just buy the same t-bill off of the secondary market at a better price for a better rate?

- What are the tax implications of doing so?

- Do I forego any tax advantages?

After reading through the IRS tax code and browsing answers from various investing forums, the taxes that you pay on the interest when the bond matures depends on how you acquired the treasury in the first place.

If you acquire them from the treasury at auction for auction price for Original Issue Discount they are fully taxable at the federal tax at income rate (because bills mature 1 year or less) and are exempt from taxation at the state and local level.

If you acquired the t-bill on the secondary market at a Market Discount, they are fully taxable at all levels.

Next Plays

With this newly gained knowledge, you can "lock in" a higher rate on short term treasury bills by choosing to acquire them on the secondary market and through a a post tax advantaged account like a Roth IRA (where you are not taxed on realized gains) in order to enjoy the fixed income, stability, and backing by the full faith and credit of the U.S. government.

Update (2/13/2025)

This week 3 bills were issued:

| Duration of Bill | CUSIP | Auction Investment Rate | Auction Price per $100 | Secondary Investment Rate | Secondary Price per $100 |

| ---- | ---- | ---- | ---- | ---- |

| 4-Week | 912797NR4 | 4.323% | 99.66 | 4.95% | 99.62 |

| 8-Week | 912797NZ6 | 4.327% | 99.34 | 4.64% | 99.29 |

| 17-Week | 912797PS0 | 4.350% | 98.60 | N/A | N/A |

We can see that for the 4-week and 8-week bill you would get a better rate on the day of auction, today, on the secondary market than at auction.